Open!Until 20 May

TITANIC: The Artifact Exhibition

Tour & Taxis, Brussels

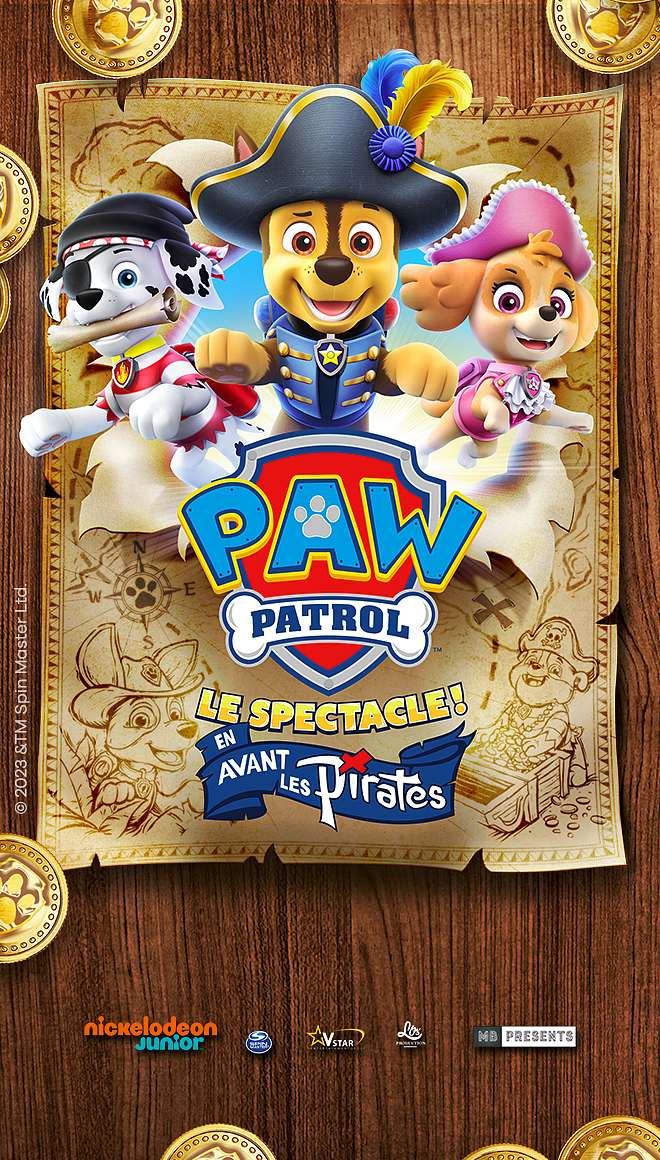

LAST TICKETS!27 & 28 avril 2024

Pat’ Patrouille, le spectacle !

Ing Arena, Bruxelles

LAST TICKETS!4, 5, 9 & 10 MAY 2024

DIRTY DANCING IN CONCERT

ANTWERP, BRUSSELS, OOSTENDE

LAST TICKETS!9, 10, 11 & 12 MAY 2024

Brel! The Show

BRUSSELS, LIÈGE

Last tickets!11 MAY 2024

The Ultimate Tribute to Michael Jackson

Cirque Royal, Brussels

Last tickets!19,23 MAY & 21 NOV 2024

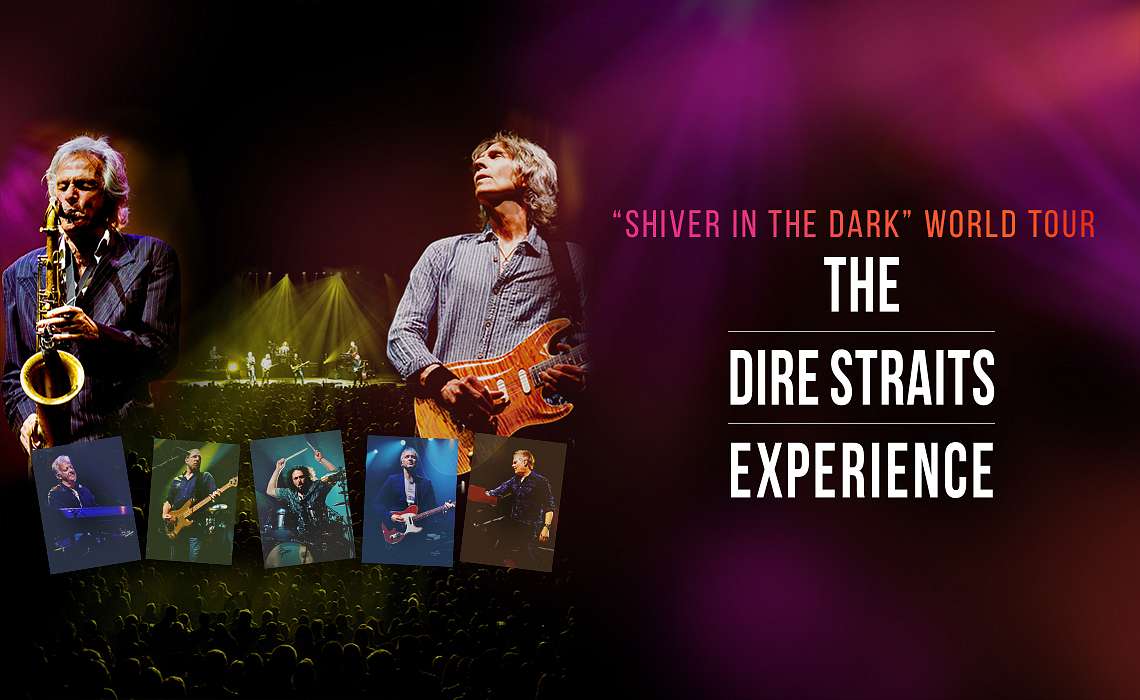

Dire Straits Experience

Bruges, Antwerp, Brussels